Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Python is one of the most widely used coding languages in the world. And, good news, it isn&t very difficult to learn — especially for those experienced using other platforms. If you want an introduction to the language, but would rather avoid a traditional college education, then give The Complete 2020 Python Programming Certification Bundle a try.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Train to become a skilled Python coder for just $50

Write comment (96 Comments)

We hear the terms "deep web" and "dark web" thrown around a lot but what do they actually mean? And what's the difference between the two? CSO Online writer J.M. Porup joins Juliet to dispel rumors and discuss what sets the deep web and dark web apart from the rest of the web.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: What's the difference between the deep web and the dark web

Write comment (93 Comments)

Does your voice assistant wake up randomly when you are engaged in normal conversation, listening to radio, or watching TV? You&re not alone, and this could have serious implications in enterprise security policy.

All things being equal (they&re not)

&Anyone who has used voice assistants knows that they accidentally wake up and record when the 'wake word' isn't spoken - for example, 'seriously' sounds like the wake word 'Siri' and often causes Apple's Siri-enabled devices to start listening," the Smart Speakers research study says.

To read this article in full, please click here

- Details

- Category: Technology Today

Read more: Why every user needs a smart speaker security policy

Write comment (96 Comments)Fintech startup Revolut is raising a large Series D round of funding. TCV is leading the $500 million round, valuing the company at $5.5 billion. Over the past few years, Revolut has raised $836 million in total.

Some existing investors are also participating in todayfunding round, but Revolut isn&t sharing names. Previous investors include DST Global, Index Ventures, Balderton Capital and many others.

If you&re not familiar with Revolut, the company is building a financial service to replace traditional bank accounts. You can open an account from an app in just a few minutes. You can then receive, send and spend money from the app or using a debit card.

On top of that, Revolut has added a ton of features that it has built in-house or through partnerships. You can insure your phone, get a travel medical insurance package, buy cryptocurrencies, buy shares, donate to charities, save money and more.

Revolut currently has more than 10 million customers, mostly in Europe and the U.K. The company doesn&t share specific numbers when it comes to transaction volume and monthly active customers, but here are some percentage-based metrics:

- The total number of users has grown by 169% in 2019.

- Daily active customers grew by 380% in 2019.

- Revenue grew by 354% in 2018 (yes, 2018).

- Revenue from premium subscription plans (Revolut Premium and Revolut Metal) have grown by 154% in 2019.

With the new influx of cash, the company says that it&ll focus on improving its product for existing users as well as revenue. Itall about making Revolut more useful and stickier going forward.

In particular, you can expect new lending services for both retail customers as well as companies using Revolut for Business. While Revolut provides a ton of services in the U.K., customers in other markets don&t have the same feature set. For instance, Revolut recently launched savings vaults in the U.K. — customers in other markets will be able to open savings sub-accounts in the future, as well.

Other than that, Revolut wants to double down on the core features. The company will improve its two subscription tiers (Premium and Metal) and improve banking operations across Europe —you can expect full bank accounts in Europe in the future.

There are currently 2,000 people working for Revolut. &We&re on a mission to build a global financial platform — a single app where our customers can manage all of their daily finances, and this investment demonstrates investor confidence in our business model. Going forward, our focus is on rolling-out banking operations in Europe, increasing the number of people who use Revolut as their daily account, and striving towards profitability,& Revolut co-founder and CEO Nik Storonsky said in the release.

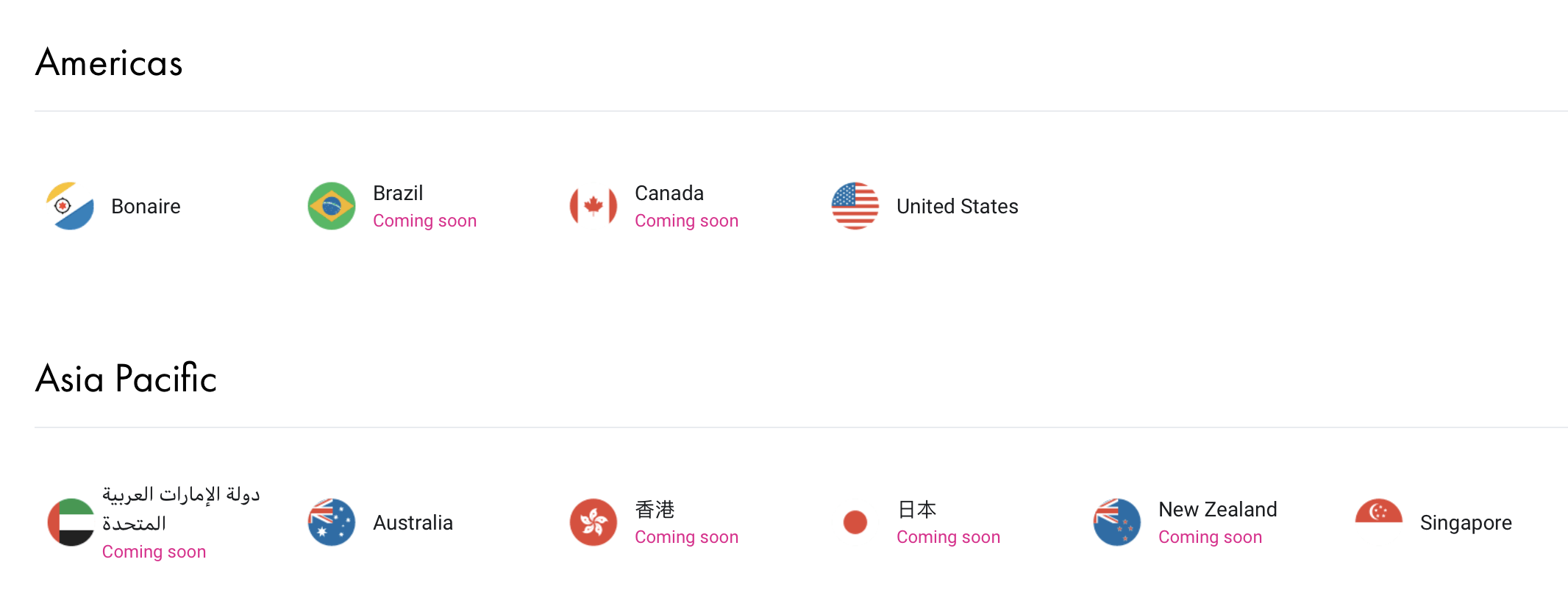

Revolut is currently live in the U.K., Europe, Singapore and Australia (in beta). While the company has announced plans to expand to a handful of countries, the main focus is on launching in the U.S. and Japan in the coming months.

- Details

- Category: Technology Today

Read more: Revolut raises $500 million at a $5.5 billion valuation

Write comment (92 Comments)

- Details

- Category: Technology Today

Read more: Only AI can save us from a world of fakes (a world AI is also creating)

Write comment (98 Comments)

Oxx, a European venture capital firm co-founded by Richard Anton and Mikael Johnsson, this month announced the closing of its debut fund of $133 million to back &Europemost promising SaaS companies& at Series A and beyond.

Launched in 2017 and headquartered in London and Stockholm, Oxx pitches itself as one of only a few European funds focused solely on SaaS, and says it will invest broadly across software applications and infrastructure, highlighting five key themes: &data convergence - refinery,& &future of work,& &financial services infrastructure,& &user empowerment& and &sustainable business.&

However, its standout USP is that the firm says it wants to be a more patient form of capital than investors who have a rigid Silicon Valley SaaS mindset, which, it says, often places growth ahead of building long-lasting businesses.

I caught up with Oxxco-founders to dig deeper into their thinking, both with regards to the firmremit and investment thesis, and to learn more about the paircriticism of the prevailing venture capital model they say often pushes SaaS companies to prioritize &grow at all costs.&

TechCrunch: Oxx is described as a B2B software investor investing in SaaS companies across Europe from Series A and beyond. Can you be more specific regarding the size of check you write and the types of companies, geographies, technologies and business models you are focusing on?

Richard Anton: We will lead funding rounds anywhere in the range $5-20 million in SaaS companies. Some themes we&re especially excited about include data convergence and the refining and usage of data (think applications of machine learning, for example), the future of work, financial services infrastructure, end-user empowerment and sustainable business.

- Details

- Category: Technology Today

Read more: VC firm Oxx says SaaS startups should avoid high-risk growth models

Write comment (92 Comments)Page 1398 of 1441

16

16