Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

The coronavirus outbreak has forced millions of U.S. employees to work from home — many for the first time. But remote work can be lonely and isolating, as people feel disconnected from their team and co-workers due to the lack of face-to-face conversations. Thatwhere the new startup, Hallway, aims to help. The service re-creates the break-room experience and the serendipity of random hallway conversations with its new app aimed at Slack users.

The app allows companies to schedule 10-minute video chats within Slack channels, where colleagues can catch up with one another outside of more formal web meetings.

The startup was co-founded by Parthi Loganathan, a former product manager at Google who launched Google Chat and Google Go; and Kunal Jasty, a former associate at private equity firm Insight Partners.

The two were originally working on a product called Across that would help teams provide customer support in shared Slack channels. But when the shelter-in-place was brought into effect in San Francisco, things quickly changed.

&It forced a lot of companies that were unprepared for remote work to go remote overnight,& Loganathan explains. Meanwhile, his roommate complained he was going stir-crazy working from home and missed talking to his team.

&Hallway seemed like a simple and fun way to tackle that problem, so we built it in a couple of days,& Loganathan says.

The founders already had first-hand experience with the challenges involved in dealing with remote teams, as half their team was based in India. And they had experience building Slack apps, not only with Across but with others similar to Hallway, as well.

As a result, Hallway was built quickly, with only four days in between the idea and the first user, Loganathan says.

To use Hallway, you can either add it to Slack from the Hallway website or from the Slack app directory. (To install it, you may need admin approval if you don&t have permission to add apps to your Slack workspace.)

Thereno front-end for the app — everything is user-facing in Slack, including the login process, onboarding experience and the settings user interface. Once installed, you&re given the onboarding instructions over direct message within Slack. You can then invite the Hallway bot to any Slack channel by typing /invite @hallway. This kicks off the bot to start creating break rooms on a recurring basis automatically, which are announced by way of an @here message.

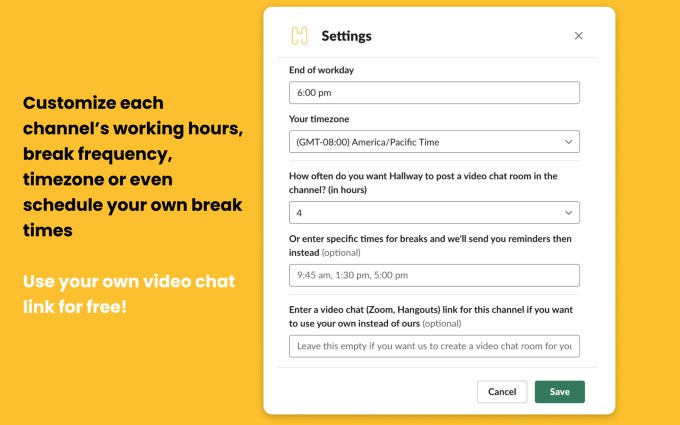

By default, Hallwaybreak rooms are scheduled every two hours between 9 AM and 6 PM Monday through Friday, but users can adjust the timezone and adjust the frequency of the breaks by typing in /hallway in a Slack channel to customize the settings.

You can opt to use your own Zoom or Google Meet links with Hallway. But the experience works better with Hallwaytimed video chat rooms, which are powered by daily.covideo infrastructure.

The service itself is free for up to two slack channels, but only offers 10 of its timed video chats before you have to either switch to using your own web meeting links or have to upgrade.

Hallway&team& pricing plan for larger companies supports up to five channels and offers an unlimited number of video chat rooms, as well as the customization options, for $30 per month. For more than five channels, enterprise pricing is available upon request.

Since launching just a few weeks ago, Hallway has quickly grown its customer base.

The service is now being used by more than 170 teams at companies like Nextdoor, Productboard, Bank Novo, Pivotal, Coursera and others. The majority of users are on the free plan for now. However, companies in need of an upgrade can access more flexible pricing if users are willing to share the service with friends.

For the time being, the co-founders want to focus on improving the Hallway experience in Slack, but they&re already thinking about what comes next.

&We&re solving the problem of keeping teams connected and reducing workplace loneliness while working remotely. Right now, we&re improving the core experience of spontaneous timed video chats and giving users more options to customize them,& says Loganathan. &We&re looking into specific use cases we can help companies with, like team building and employee onboarding for remote teams,& he notes.

The company may also consider a solution for Microsoft Teams in the future, he says.

Hallway has raised an undisclosed amount of pre-seed funding.

- Details

- Category: Technology Today

PayPal, Intuit Square accepted to provide lendings to local business with coronavirus relief program

Fintech companies have been lobbying for weeks to be able to participate in the U.S. governmentemergency lending program for small businesses. Now those efforts have paid off, as PayPal, Intuit and Square have all been approved to participate in the U.S. Small Business Administration(SBA) Paycheck Protection Program, which provides aid in the form of forgivable loans for small businesses that keep all employees on their payroll for at least eight weeks.

The $350 billion small business loan program is a part of Congress$2 trillion coronavirus stimulus package, and is aimed at those businesses with fewer than 500 employees.

PayPal on Friday announced it had been approved as one of the first non-bank institutions able to help distribute the loans under the SBA program, after having received its approval to participate in the program.

The company has already operated as a small business lender before today, it noted. Since 2013, PayPal has provided loans and cash advances to business owners. Those efforts, to date, have provided access to more than $15 billion in funding for over 305,000 small businesses.

&We are eager to deploy our capital and expertise to do our part in helping small businesses survive this challenging period,& said PayPal President and CEODan Schulman, in astatement.&The first loans have been applied for and issued. We expect more loans to be issued in the coming days. Thanks to Congressional leaders and the Administration for ensuring the CARES Act allowed companies like PayPal to help distribute funds quickly to those businesses that are most impacted,& he added.

Meanwhile, Intuit on Monday detailed several of its new programs launched in response to the COVID-19 crisis and the resulting governmental aid programs. It debuted the latest of these efforts with the launch of Intuit Aid Assist, a free website designed to help small business owners and self-employed assess how much federal relief they&re eligible for under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, administered by the SBA.

And like PayPal, IntuitQuickBooks Capital on Friday received approval as a non-bank lender for the SBAPaycheck Protection Program (PPP).With QuickBooks Capital, small business owners are able to get assistance with determining their eligibility for the federal relief. The software simplifies the application process using automation, as well. In coordination with the SBA, it then disburses the PPP funds, making it faster to gain access to the relief.

&Many consumers and small businesses are struggling to make ends meet and provide for their families. They are facing a loss of income and a lack of savings to weather the storm,& said Intuit CEO Sasan Goodarzi. &The U.S. government has stepped in with much-needed relief and we&re partnering closely to help. We applied our artificial intelligence and rapid innovation capabilities to help Americans navigate these offerings and get access to the relief they need quickly,& Goodarzi said.

Intuit had also recently launched Stimulus Registration, a new service from Turbo Tax aimed at helping consumers register to receive their stimulus checks from the government. In less than two weeks& time, Intuit says more than 165,000 Americans used the service to register for more than $230 million in federal stimulus money.

Square Capital on Monday joined PayPal and Intuit with its announcement of having received SBA approval as a PPP lender. The company said it would start rolling out its PPP loan applications this week, working in partnership with Celtic Bank.

Square Capital said it would notify sellers through Square Dashboard when their application is available, starting with employers whose application data can be verified automatically.

Online lenders and fintech companies have been lobbying to become authorized SBA lenders over the past few weeks.

On Thursday, the U.S. Treasury responded by publishing a form that would allow fintech companies to apply for approval to the SBA lending program. But the lack of approval hadn&t stopped some online fintech firms from soliciting applications from those seeking relief, NBC News recently reported. Kabbage, for example, initially failed to note on its website it wasn&t yet an approved lender, the report said.

An alliance of fintech technology leaders known as Financial Innovation Now in March had written a letter to lawmakers that asked to participate alongside banks in the distribution of funds to small businesses. The alliance — which includes Square, PayPal, Intuit, Stripe and others — argued they had &the reach, relationships, and digital capabilities to reach those businesses most vulnerable& in a more timely fashion than traditional financial institutions.

- Details

- Category: Technology Today

Clearbanc, a Toronto-based company that funds startups through equity-free investments, has laid off 17 employees to help it navigate the long-term economic impact of COVID-19, TechCrunch has learned.

The cuts impact about 8% of the staff, affecting roles ranging from office managers to recruiters and sales. Co-founder Michele Romanow says the company will use its connections to assist those affected by the layoffs to search for other work, and offer extended benefits through the end of the financial quarter.

Clearbanc has been noisy in its journey toward being a venture capital alternative for startups. Just last week, Clearbanc announced a new financing product to help startups avoid cutting staff and stay operationally afloat: Clearbanc Runway. And last year, it pushed out its &20-minute term sheet& to sell equity-free capital with a promise of founder friendliness. The model has seen the startup disburse $1 billion to nearly 2,200 companies so far, per its accounting.

In July 2019, the fintech company raised a $250 million fund and $50 million in equity to broaden its investment goals. The co-founders say Clearbanc is continuing to see an increased demand for its capital. It hired more than 140 people last year alone.

Clearbanc is in a somewhat unique position during this downturn, as it largely funds e-commerce businesses that have seen an uptick in usage as brick-and-mortar stores becomes less of an option due to social distancing.

However, last week, co-founder Andrew D&Souza pointed to unpredictable market conditions: &Therea lot of volatility and a lot of uncertainty,& he said.

&We&re certainly going to be more conservative than we would have been six months ago. It probably looks like us writing smaller checks, more frequently,& he told TechCrunch last week.

Todaylayoffs, according to the company, don&t directly impact Clearbancability to cut checks. Instead, the Clearbanc cuts signal that layoffs aren&t reserved for the time when the dry powder runs out. As the pandemic draws out, we&re learning that sometimes ita bit more preemptive than that.

A storm of layoffs have impacted a wide range of startups and industries across the world. While travel and hospitality companies have felt the blunt of the pandemiceconomic impact, broader cuts show that sales and recruiting teams from other industries are also vulnerable. Layoffs have been so ubiquitous that platforms have risen to help those laid off find their next gig. And in a time where uncertainty rules week to week, any effort to create meeting grounds for those with this tough shared experience is much welcome.

- Details

- Category: Technology Today

Read more: Clearbanc cuts team to browse 'long-term financial influences' of COVID-19

Write comment (99 Comments)Apple and Google reveal a joint effort to track the spread of COVID-19, a new study shows how fringe coronavirus theories are making their way to the mainstream and — in happier news — we get some hints on Applehardware plans for the fall. Hereyour Daily Crunch for April 13, 2020.

1. Apple and Google are launching a joint COVID-19 tracing tool for iOS and Android

Apple and Google engineering teams have banded together to create a decentralized contact tracing tool that will help individuals determine whether they have been exposed to someone with COVID-19.

The first phase of the project is an API that public health agencies can integrate into their own apps. The next phase is a system-level contact tracing system that will work across iOS and Android devices on an opt-in basis.

2. Coronavirus conspiracies like that bogus 5G claim are racing across the internet

According to Yonder, an AI company that monitors online conversations including disinformation, conspiracies that would normally remain in fringe groups are traveling to the mainstream faster during the epidemic.The company estimates that it would normally take six to eight months for a &fringe narrative& to make its way from the edges of the internet into the mainstream, while that interval looks like three to 14 days in the midst of COVID-19.

3. Apple said to be planning fall iPhone refresh with iPad Pro-like design

Apple is readying a new iPhone for fall to replace the iPhone 11 Pro this fall, Bloomberg reports, as well as follow-ups to the iPhone 11, a smaller HomePod and a locator tag accessory.

4. Amazon to hire 75,000 more to address increased demand due to coronavirus crisis

The company said its hiring efforts can help mitigate some of the job loss and furloughing that has resulted from the economic crisis that is also occurring as part of the COVID-19 pandemic. In fact, Amazon positioned its openings as an option for anyone looking to seek work &until things return to normal and their past employer is able to bring them back.&

5. Checking on Utahstartup scene as the economy slips

TechCrunch is taking a closer look at a few startup markets as the world changes. Following our dive into Boston late last week, we&re widening our scope and taking a peek at the state of Utah. (Extra Crunch membership required.)

6. Tesla resurrects long-range RWD Model 3 for the Chinese market

Tesla is now producing and selling the long-range, rear-wheel-drive version of its Model 3 electric vehicle at its Shanghai factory. The move is notable because Tesla discontinued production of the long-range RWD Model 3 in the U.S. This also marks a shift from Teslainitial plan to sell a more basic version of the Model 3 in China.

7. This weekTechCrunch podcasts

The latest full-length episode of Equity rounds up a bunch of different fintech stories (including SoFi$1.2 billion purchase of Galileo), while the Monday news roundup looks at some of SoftBanklatest financial numbers. And over on Original Content, we had some pretty strong feelings about the initial content lineup at Quibi.

The Daily Crunch is TechCrunchroundup of our biggest and most important stories. If you&d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

- Details

- Category: Technology Today

Read more: Daily Grind: Apple and also Google announce contact tracing initiative

Write comment (94 Comments)There are early signs that media will be one of many industries to take a huge blow from the COVID-19 pandemic, with sharp declines in ad revenue and significant layoffs. Podcasting is unlikely to be an exception; Podtrac recently reported that downloads have fallen 10% since the beginning of March, while unique listeners fell by 20%.

A different picture emerged when I spoke to Ross Adams, CEO of podcast advertising company Acast, which works with both bedroom podcasters and large publishers like the BBC and PBS NewsHour.

Adams said listenership isn&t down — itjust that audiences have changed when they&re listening and what they&re listening to, with Acast seeing its largest weekends ever in recent weeks. And plenty of people want to start new podcasts; signups for the Acast Open platform increased 49% month-over-month in March.

&What we&re seeing now is an opportunity for people to discover podcasting as a medium,& he said. &And once you discover it, you stick with it.&

Advertising may be a separate issue, with Adams admitting that the downturn is likely to affect &every business that has the majority of their revenue from ads.& But even then, he sees opportunity as marketing dollars move from traditional industries like radio and out-of-home advertising.

We also discussed Acastfinancials, the podcast discovery process and tips for new podcasters. Read a transcript of our conversation, edited for length and clarity, below.

TechCrunch: Letstart with the good news. One of the prompts for this conversation is the fact that you guys announced some financial numbers — you doubled the revenue last year to $38 million. So first of all, congratulations.

Ross Adams: Thank you.

And secondly, therea lot of different factors at play and different conversations about podcasting breaking through in 2019. But when you look back, what do you see as the biggest factors that contributed to your growth?

- Details

- Category: Technology Today

Read more: Will podcast ad income recover after COVID-19

Write comment (98 Comments)The Japanese modern technology conglomerate SoftBank Group claimed it would certainly lose a shocking $24 billion on investments made with its Vision Fund as well as bank on the co-working realty firm WeWork and satellite telecommunications firm OneWeb. Inevitably, the business anticipates the losses to assist create a $7 billion overall loss for the innovation giant for the year as its ambitious bank on early-stage companies come up short. Over the previous 2 years SoftBank as well as its creator Masayoshi Child have actually bet billions of (other individuals&& s )bucks and its own fortunes on a vision that financial investments in artificial intelligence modern technologies, robotics and also next-generation telecoms would certainly enjoy thousands of billions in economic benefits. While that was the vision that Boy and his team marketed, the fact was numerous billions of dollars invested right into genuine estate financial investment plays like WeWork, OpenDoor as well as Compass, as well as firms with direct-to-consumer merchandising plays like Brandless, pet dog supply companies like Wag and also the food delivery organisation DoorDash. Add the hotel chain Oyo to the mix and also the financial investment selection from the Vision Fund looks also less visionary. Over the previous year, numerous of its investments ran marooned. Though none imploded as spectacularly as WeWork —-- whose appraisal was slashed from greater than $40 billion to around $8 billion —-- numerous have actually battled. Brandless failed previously this year, and also realty financial investments in Compass together with investments in traveling and tourism-related services like Oyo have actually endured in the wake of the COVID-19 break out, which has actually shuttered economic climates around the globe. While numerous SoftBank and also SoftBank Vision Fund bets were made into firms that have actually fallen short, seem to be on that course or maybe might battle in the financial slump, not every wager is a jalopy. The Vision Fund placed great deals of capital right into Slack before it went public, and the company has actually captured a significant tailwind in the remote-work boom that we&& re presently seeing in light of COVID-19. Possibly one of the most visionary of the SoftBank financial investments (as well as one not included in the Vision Fund), OneWeb, too, collapsed under the weight of its very own capital-intensive vision for a network of satellites supplying high-speed global telecommunications solutions. Zume, SoftBank&& s robot pizza delivery service, likewise folded up. The only factor all of these wagers haven&& t entirely destroyed SoftBank is that the firm still has a golden goose in its Alibaba stake and a reasonably solid core organisation in telecoms and semiconductor holdings. && The distinction in revenue prior to earnings tax is, in enhancement to the above, primarily as a result of the anticipated recording of non-operating loss totaling about JPY 800 billion for financial 2019 on investments held outside of SoftBank Vision Fund, including The We Business (WeWork) and also WorldVu Satellites Limited (OneWeb),& & the firm stated in a statement. & This will certainly be partly balanced out by the gain relating to the negotiation of variable prepaid forward agreement making use of Alibaba shares recorded in the initial quarter of monetary 2019 and also the dilution gain from changes in equity passion in Alibaba recorded in the third quarter of fiscal 2019, in addition to an expected year-on-year boost in revenue on equity approach financial investments pertaining to Alibaba.&& Eventually, it seems that Kid was as well enamored of the folklore he&& d produced around himself as a maverick as well as a visionary. To the hinderance of his business & s outside shareholders as well as financiers . As Bloomberg kept in mind in an op-ed earlier today: Boy&& s insistence that startups grow faster than their founders intended, and strong-arm them right into taking more money than they could have desired, has actually become a problem. Which&& s come to be a huge responsibility to financiers in the Vision Fund and also SoftBank, as well. By throwing money around, loads of startups came to be addicted to spending rather of developing fiscal discipline right into their company versions. For years, it appeared like an audio approach. By having even more money than competitors, SoftBank-backed business might win market share by using bigger incentives, taking out much more ads and luring the very best skill. Today, SoftBank has a major stake in market leaders like Uber Technologies Inc., WeWork, Grab Holdings Inc. and also Oyo. But reaching primary doesn&& t mean paying. The Japanese technology corporation SoftBank Team said it would certainly lose an incredible $24 billion on investments made via its Vision Fund as well as bets on the co-working property business WeWork as well as satellite telecoms company OneWeb. Inevitably, the business anticipates the losses to help generate a $7 billion failure for the modern technology giant for the year as its enthusiastic bank on early-stage firms lose. Over the previous 2 years SoftBank as well as its creator Masayoshi Kid have staked billions of (other individuals&& s )dollars and also its very own fortunes on a vision that financial investments in device discovering technologies, robotics and also next-generation telecoms would reap numerous billions in economic incentives. While that was the vision that Boy and also his team sold, the truth was multiple billions of dollars spent into real estate investment plays like WeWork, OpenDoor and Compass, and also companies with direct-to-consumer merchandising plays like Brandless, pet dog supply services like Wag as well as the food delivery service DoorDash. Add the hotel chain Oyo to the mix and also the investment choice from the Vision Fund looks also less visionary. Over the past year, numerous of its investments ran grounded. Though none of them imploded as marvelously as WeWork —-- whose assessment was slashed from greater than $40 billion to around $8 billion —-- lots of have battled. Brandless went breast earlier this year, and property financial investments in Compass together with investments in traveling and tourism-related services like Oyo have experienced following the COVID-19 outbreak, which has actually shuttered economies worldwide. While many SoftBank and also SoftBank Vision Fund bets were made right into firms that have fallen short, appear to be on that particular course or probably may have a hard time in the economic downturn, not every wager is a clunker. The Vision Fund put great deals of resources into Slack before it went public, and also the firm has caught a massive tailwind in the remote-work boom that we&& re presently seeing because of COVID-19. Possibly the most visionary of the SoftBank financial investments (and one not included in the Vision Fund), OneWeb, as well, collapsed under the weight of its very own capital-intensive vision for a network of satellites providing high-speed international telecoms solutions. Zume, SoftBank&& s robotic pizza distribution business, additionally folded up. The only factor all of these wagers haven&& t entirely ruined SoftBank is that the company still has a moneymaker in its Alibaba stake and a fairly strong core organisation in telecommunications and semiconductor holdings. && The difference in earnings prior to revenue tax obligation is, along with the above, primarily because of the expected recording of non-operating loss completing roughly JPY 800 billion for financial 2019 on financial investments held outside of SoftBank Vision Fund, consisting of The We Company (WeWork) as well as WorldVu Satellites Limited (OneWeb),& & the company claimed in a statement. && This will certainly be partially offset by the gain connecting to the negotiation of variable pre-paid onward agreement utilizing Alibaba shares taped in the initial quarter of financial 2019 and also the dilution gain from changes in equity rate of interest in Alibaba videotaped in the 3rd quarter of financial 2019, in addition to an anticipated year-on-year rise in revenue on equity technique investments related to Alibaba.&& Ultimately, it appears that Child was also enamored of the mythology he&& d created around himself as a maverick and also a dreamer. To the detriment of his firm&& s outside investors and also financiers. As Bloomberg noted in an op-ed earlier today: Son&& s persistence that startups expand faster than their owners prepared, as well as strong-arm them into taking even more money than they could have desired, has actually transformed into a burden. Which&& s become a substantial liability to investors in the Vision Fund as well as SoftBank, too. By throwing money around, lots of start-ups came to be addicted to investing instead of building fiscal discipline right into their service models. For many years, it looked like a sound method. By having even more money than rivals, SoftBank-backed business could win market share by offering bigger incentives, obtaining extra advertisements as well as tempting the finest ability. Today, SoftBank has a significant stake in sector leaders like Uber Technologies Inc., WeWork, Grab Holdings Inc. as well as Oyo. But climbing up to number one doesn&& t mean paying.

- Details

- Category: Technology Today

Page 995 of 1446

13

13