Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

Facebook has enjoyed unparalleled reach in India for more than a decade. But as Chinafast-growing ByteDance emerges as a formidable competitor in what has become the worldsecond largest internet market, the American social media giant has found the horse it wants to bet on in the new decade.

The worldlargest social media company announced today it has invested $5.7 billion for a 9.99% stake in IndiaReliance Jio Platforms, a three-and-a-half-year-old subsidiary of the nationmost valued firm, Reliance Industries, and the biggest telecom operator in the country with more than 370 million subscribers.

The deal, which valued Jio at a pre-money valuation of $65.95 billion, makes Facebookthe largest minority shareholder in the Indian telecom network.

The social giant said the investment marks its &commitment to India&, where it willfocus on collaborating with Jio to create &newways for people and businesses to operate more effectively in the growing digital economy.& This is the largest investment for a minority stake by a technology company anywhere in the world and the largest foreign direct investment in the technology space in India.

One possible collaboration could be, saidDavid Fischer, Chief Revenue Officer at Facebook, and Ajit Mohan, VP and Managing Director of Facebook India, bringing togetherJioMart, an e-commerce business that is a joint venture between Jio and Reliance Retail(nationlargest retail chain), with WhatsApp, which counts India as its biggest market with more than 400 million users. (Facebookmarquee service reaches about 350 million users in India, it says on its website for brands.)

&We can enable people to connect with businesses, shop and ultimately purchase products in a seamless mobile experience,& they said.

Reliance Jio, which began its commercial operation in the second half of 2016, upended the local telecom market by offering bulk of 4G data and voice calls for six months to users at no charge. The telco kickstarted a price war that forced local network providers Vodafone and Airtel to revise their data plans and mobile tariffs; however, they struggled to match the offerings of Jio, which has become the top telecom operator in the country.

Reaching Jiousers might interest Facebook, which attempted and failed to expand its free internet initiative, Free Basics, in India. (The company has since expanded Express Wi-Fi to India — though its potential and scale remains comparatively small.)

Reliance Jio also owns a suite of services including music streaming service JioSaavn (which it plans to take public), smartphones, broadband business, on-demand live television service JioTV, and payments service JioPay.

Photo: Dhiraj Singh/Bloomberg via Getty Images

&We&re making a financial investment, and more than that, we&re committing to work together on some major projects that will open up commerce opportunities for people across India,& said Mark Zuckerberg, co-founder and chief executive of Facebook, in a post.

In recent quarters, Facebook has started to take interest in Indian startups. Last year, the firm made an investment in social commerce Meesho; and earlier this year, it wrote a check to edtech startup Unacademy. Facebook has invested around $15 million each in these two startups.

Mohan told TechCrunch in an interview last year that the company was open to engaging with startups that are building solutions for the Indian market for more investing opportunities. &Wherever we believe there is opportunity beyond the work we do today, we are open to exploring further investment deals,& he said. Though a multi-billion dollar investment comes as a surprise.

But for Facebook, there might be an additional perk in this deal: Mukesh Ambani. Indiarichest man is a close ally of Indian Prime Minister Narendra Modi, and his firm has consistently supported policy proposals from the ruling government. Just so it happens, Facebook has received more scrutiny than ever in India in recent years under Modigovernment.

In a video message, Ambani said, &At the core of our partnership is the commitment that Mark Zuckerberg and I share for the all-around digital transformation of India and for serving all Indians. Together, our two companies will accelerate Indiadigital economy to empower you, enable you, and to enrich you.&

&The synergy between Jio and Facebook will help realise Prime Minister Shri Narendra Modi‘Digital India& Mission with its two ambitious goals — ‘Ease of Living& and ‘Ease of Doing Business& & for every single category of Indian people without exception. In the post-Corona era, I am confident of Indiaeconomic recovery and resurgence in the shortest period of time. The partnership will surely make an important contribution to this transformation,& he said in a statement.

Ambani added that JioMart and WhatsApp will enable 30 million neighborhood stores (kirana) to transact digitally &in the near future.& WhatsApp has been working with the Indian government for more than two years to expand its payments service in India — but the project remains stuck in regulatory hurdles.

For more than a decade, the Indian market has been a duopoly between Facebook and Google. Reliance Jio has built consumer-facing services, but very few that compete directly with either of the American giants& core offerings. But in recent years, ByteDanceTikTok has won users that all of these companies have struggled to reach. TikTok has amassed more than 250 million users in India (as of last year), and the company says it is on track to add another 100 million this year.

Jayanth Kolla, an analyst with Convergence Catalyst, said TikTok blindsided Facebook and reached users that the American company hadn&t yet. Facebook has, predictably, attempted to build a similar service called Lasso. But itcurrently testing it in limited markets, and India is not one of them.

- Details

- Category: Technology Today

Read more: Facebook invests $5.7B in India’s Reliance Jio

Write comment (97 Comments)Mattress company Casper is shutting down its European operations and laying off 78 people as it focuses on &achieving profitability,& according to a statement by the company. The layoff impacts 21% of its corporate workforce globally.

In the statement, the company said that it is winding down European operations to &concentrate on the strength of the North American business.& The action out will result in more than $10 million in annualized savings, per the company.

The company also noted that CasperCFO and COO, Gregory Macfarlane, will be departing from the company on May 15.

Casper said it will give impacted employees in both North America and Europe severance, extended medical coverage, career coaching and new job placement support.The company did not immediately return a request for comment.

In the months since itslackluster IPOandtroubled public market debut in February, the company has struggled amid the COVID-19 pandemic. Last month it announced it will shut down all retail locations and furlough all retail employees.

Ahead of going public, Casper hinted at some struggles. The company cut its valuation by more than 50% by lowering its expected price range from between $17 to $19 per share to between $12 and $13.

Casper was one of the recent tech unicorns to make it to the public market, and might be for a while given an increasingly tumultuous economic environment. Tech unicorns have not been immune to the massive number of layoffs seen around the world right now. GetAround, Knotel, Sonder, ZipRecruiter, TripActions and Bird are all among the second wave of unicorn layoffs.

As reported by Crunchbase News with data from layoffs.fyi, 46% of all reported layoffs for private companies come from unicorn companies. Roughly 36 private unicorn companies have laid off staff since the COVID-19 outbreak, according to the data.

Itworth remembering that amid these massive layoffs, it is likely that employees in satellite offices will likely be affected. Casper is a clear example of this, as the New York-based company cuts its Europe team.

The company is throwing up warning signs ahead of Q1 earnings, which it will report on May 21, 2020.

- Details

- Category: Technology Today

Read more: Casper winds down European operations and lays off 78 people

Write comment (99 Comments)

Porsche is producing three variants of its all-electric Taycan sports sedan with base prices that range from a skosh over $105,000 to $185,000.

Now, it seems the automaker is preparing to introduce a cheaper rear-wheel-drive version, according to an interview in Car Magazine with Porsche R-D chief Michael Steiner. This newer version, which will join the Taycan Turbo S, Taycan Turbo and 4S, will have a smaller battery and be sold in markets like China that don&t need all-wheel drive, Steiner said.

Porsche wouldn&t provide any specific details to TechCrunch about this mystery fourth variant of the Taycan. The German automaker said it doesn&t talk about future products, before adding that its &electrification initiative will not stop with just three Taycan variants.&

After years and more than $1 billion in initial investment, Porsche introduced in September two variants of its first all-electric vehicle — the Taycan Turbo S and Taycan Turbo, with base prices of $185,000 and $150,900, respectively.

The company revealed just seven weeks later the Taycan 4S, a third version of its all-electric vehicle.

All the Taycans, including the 4S, have the same chassis and suspension, permanent magnet synchronous motors and other bits. The 4S is lighter, cheaper and slightly slower than the high-end versions.

The standard 4S is, so far, the cheapest Taycan available, with a base price of at $105,250, including a delivery fee. The standard 4S comes with a 79.2 kWh battery pack and a pair of electric motors that produce 482 horsepower (360 kW). With the launch control engaged, the horsepower jumps to 562.

Therealso a performance-battery-plus version of the 4S that adds $6,580 to the base price and comes with a 93.4 kWh battery and dual electric motors that can produce up to 563 hp (420 kW). Both of the 4S models have a top speed of 155 miles per hour and can travel from 0 to 60 mph in 3.8 seconds.

- Details

- Category: Technology Today

Read more: Porsche to produce a cheaper variation of its all-electric Taycan

Write comment (98 Comments)Swiggy is cutting about 1,000 jobs, most from its cloud kitchen division, as Indiatop food delivery startup scales back some of its businesses in response to the coronavirus pandemic that has drastically affected millions of firms.

In a statement, the Bangalore-based startup said it was &evaluating various means to stay nimble and focus on growth and profitability across our kitchens.&

&This will, unfortunately, have an impact on a certain number of kitchen staff who will be fully supported during this transition,& said the startup, which, according to an analysis on LinkedIn, employs about 12,000 people.

Swiggy did not reveal the number of people it was letting go, but a source familiar with the matter told TechCrunch that about 1,000 jobs were being cut. Indian news outlet Entrackr first reported the layoffs.

As the firm cuts its headcount, it is also looking to reduce its monthly burn rate to about $5 million, down from about $20 million it spends in winning customers currently, the source said, requesting anonymity as some of these matters remain private.

Swiggy — which has raised $1.42 billion to date, including$156 million as part of an ongoing Series I roundthis year — competes with Ant Financial-backed Zomato, which is also in talks to raise about $500 million by mid-May, Deepinder Goyal, the co-founder and chief executive of the Gurgaon-based startup, told TechCrunch last week.

Both the startups spend nearly the same amount of money in discounts and other incentives to sustain their customers and win new patrons. Indiafood delivery market, valued at $4 billion (by research firm RedSeer), has become a duopoly as FoodPanda, owned by Ola, made a major strategic shift in recent years and Uber sold its Indian Uber Eats business to Zomato.

Swiggy and Zomato have, however, struggled to cut costs in fear that they might lose customers. And those fears are well founded.

Anand Lunia, a VC at India Quotient, said that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform, as otherwise most of their customers can&t afford them.

The lockdown that New Delhi ordered last month has created new challenges for both Swiggy and Zomato. Both the startups are now seeing fewer than a million orders placed on their platforms, down from nearly 3 million they were handling before the outbreak.

In the last year, both the startups have attempted to expand into new categories in search of additional revenue sources. Swiggy has expanded and doubled down on cloud kitchens, which allows its restaurant partners to launch in more locations with not as much investment.

Late last year, Swiggy executives said they had established 1,000 cloud kitchens for itsrestaurant partners in the country — more than any of its local rivals. The startup said it had invested in more than a million square feet of real estate space across 14 cities in the country in the last two years.

In the wake of pandemic, both Swiggy and Zomato have also started delivering grocery items to customers.

- Details

- Category: Technology Today

Read more: Indian food delivery startup Swiggy is cutting about 1,000 jobs

Write comment (94 Comments)A new federal aid package designed to provide economic relief to businesses still immobilized by the coronavirus just passed in the Senate.

The $484 billion in total aid passed after two weeks of negotiations between Republicans, who wanted to press additional small business funding forward without much reevaluation, and Democrats, who were eventually able to secure additional relief measures beyond the small business funding at the heart of the bill.

The focal point of the new legislation is the $310 billion it will allocate to the Paycheck Protection Program, a key feature of the first relief package. That program was beset by problems from the outset, with a huge portion of small business owners failing to secure the forgivable loans through banks even with prompt applications in the programearliest moments.

Within a few days of going live, it became clear the application process was plagued by issues, and its massive $349 billion pool of funds had already dried up. Some small business owners also reported that they couldn&t find a bank to accept their application, as some banks prioritized existing customers.

Among those issues: Some of the money was sucked dry by entities that a program for small businesses probably shouldn&t be helping out to begin with. Remarkably, even hedge funds, major restaurant chains and Harvard University cashed in on the loans under the existing terms, while most owners of actually small businesses were left high and dry.

Companies with fewer than 500 employees were eligible for the loans, which become forgivable if the money is put toward payroll by hiring back or retaining employees. The maximum loan under the PPP is 2.5 times a companyaverage monthly payroll, up to $10 million.

Out of the new $321 billion, $60 billion will go to smaller lenders and credit unions that can provide loans to small businesses that might not bank with major financial institutions. Other measures Democrats secured in the new legislation include an additional $75 billion for hospitals and $25 billion for a national COVID-19 testing strategy, funding that comes with a requirement that the Trump administration form a &strategic plan& for helping states with testing.

The interim bill does not include any funding for a vote by mail system — federal funds that some Democratic lawmakers and a bipartisan group of state election officials view as essential for conducting safe voting this fall. Additional funding to help adapt and administer the 2020 election is likely to be a big talking point in the next wave of relief legislation.

The latest relief bill, which President Trump has signaled he will sign, will now move to the House, where it is expected to pass on Thursday.

- Details

- Category: Technology Today

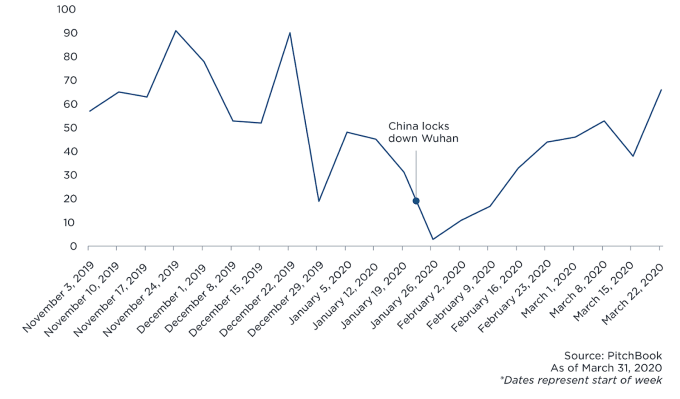

For the past month, VC investment pace seems to have slacked off in the U.S., but deal activities in China are picking up following a slowdown prompted by the COVID-19 outbreak.

According to PitchBook, &Chinese firms recorded 66 venture capital deals for the week ended March 28, the most of any week in 2020 and just below figures from the same time last year,& (although 2019 was a slow year). There is a natural lag between when deals are made and when they are announced, but still, there are some interesting trends that I couldn&t help noticing.

While many U.S.-based VCs haven&t had a chance to focus on new deals, recent investment trends coming out of China may indicate which shifts might persist after the crisis and what it could mean for the U.S. investor community.

Image Credits: PitchBook

- Details

- Category: Technology Today

Read more: Will China's coronavirus-related patterns form the future for American VCs

Write comment (94 Comments)Page 919 of 1444

7

7