Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

Technology

- Details

- Category: Technology Today

Read more: Elon Musk's Starlink satellites visible tonight together with Lyrid Meteor Shower

Write comment (98 Comments)A massive database storing millions of credit card transactions has been secured after spending close to three weeks exposed publicly to the internet.

The database belongs to Paay, a card payments processor based in New York. Like other payment processors, the company verifies payments on behalf of selling merchants, like online stores and other businesses, to prevent fraudulent transactions.

But because there was no password on the server, anyone could access the data inside.

Security researcher Anurag Sen found the database. He told TechCrunch that he estimates there are about 2.5 million card transaction records in the database. After TechCrunch contacted the company on his behalf, the database was pulled offline.

&On April 3, we spun up a new instance on a service we are currently in the process of deprecating,& said Paay co-founder Yitz Mendlowitz. &An error was made that left that database exposed without a password.&

Two records from the exposed database. TechCrunch has blacked out the full credit card number in the record to prevent fraud.

The database contained daily records of card transactions dating back to September 1, 2019 from a number of merchants. TechCrunch reviewed a portion of the data. Each transaction contained the full plaintext credit card number, expiry date and the amount spent. The records also contained a partially masked copy of each credit card number. The data did not include cardholder names or card verification values, making it more difficult to use the credit card for fraud.

Mendlowitz disputed the findings. &We don&t store card numbers, as we have no use for them.& TechCrunch sent him a portion of the data showing card numbers in plaintext, but he did not respond to our follow-up.

Itthe third payments processor this year to admit a security lapse. In January, Sen found another payments processor with an exposed database storing 6.7 million records. Earlier this month, another researcher found two payment sites for paying court fines and utilities also left a cache of data exposed for several months.

Mendlowitz said the company was informing between 15 and 20 merchants, and that the company has engaged an unnamed forensic auditor to understand the scope of the security lapse.

- Details

- Category: Technology Today

Read more: New York payments startup exposed millions of credit card numbers

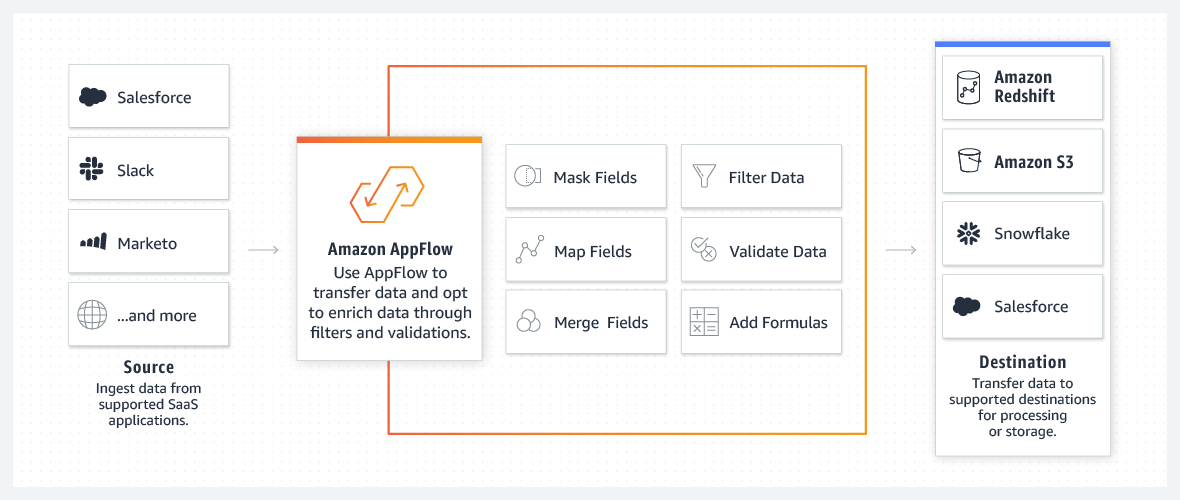

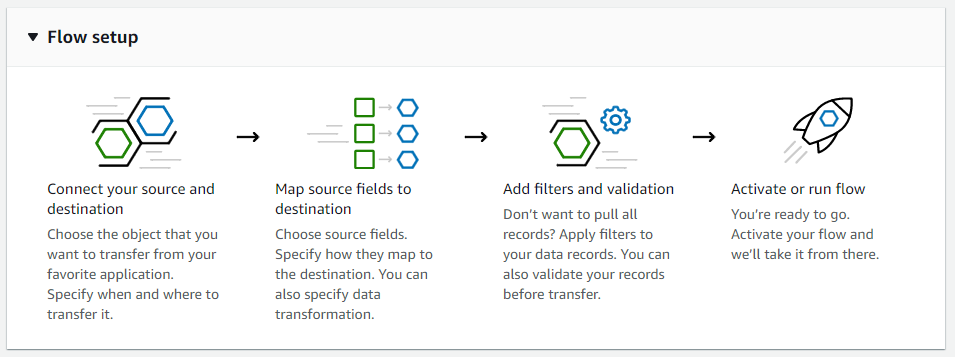

Write comment (98 Comments)AWS today launched Amazon AppFlow, a new integration service that makes it easier for developers to transfer data between AWS and SaaS applications like Google Analytics, Marketo, Salesforce, ServiceNow, Slack, Snowflake and Zendesk. Like similar services, including Microsoft AzurePower Automate, for example, developers can trigger these flows based on specific events, at pre-set times or on-demand.

Unlike some of its competitors, though, AWS is positioning this service more as a data transfer service than a way to automate workflows and while the data flow can be bi-directional, AWSannouncement focuses mostly on moving data from SaaS applications to other AWS services for further analysis. For this, AppFlow also includes a number of tools for transforming the data as it moves through the service.

&Developers spend huge amounts of time writing custom integrations so they can pass data between SaaS applications and AWS services so that it can be analysed; these can be expensive and can often take months to complete,& said AWS principal advocate Martin Beeby in todayannouncement. &If data requirements change, then costly and complicated modifications have to be made to the integrations. Companies that don&t have the luxury of engineering resources might find themselves manually importing and exporting data from applications, which is time-consuming, risks data leakage, and has the potential to introduce human error.&

Every flow (which AWS defines as a call to a source application to transfer data to a destination) costs $0.001 per run, though, in typical AWS fashion, therealso cost associated with data processing (starting at 0.02 per GB).

Every flow (which AWS defines as a call to a source application to transfer data to a destination) costs $0.001 per run, though, in typical AWS fashion, therealso cost associated with data processing (starting at 0.02 per GB).

&Our customers tell us that they love having the ability to store, process, and analyze their data in AWS. They also use a variety of third-party SaaS applications, and they tell us that it can be difficult to manage the flow of data between AWS and these applications,& said Kurt Kufeld, Vice President, AWS. &Amazon AppFlow provides an intuitive and easy way for customers to combine data from AWS and SaaS applications without moving it across the public Internet. With Amazon AppFlow, our customers bring together and manage petabytes, even exabytes, of data spread across all of their applications & all without having to develop custom connectors or manage underlying API and network connectivity.&

At this point, the number of supported services remains comparatively low, with only 14 possible sources and four destinations (Amazon Redshift and S3, as well as Salesforce and Snowflake). Sometimes, depending on the source you select, the only possible destination is AmazonS3 storage service.

Over time, the number of integrations will surely increase, but for now, it feels like therestill quite a bit more work to do for the AppFlow team to expand the list of supported services.

AWS has long left this market to competitors, even though it has tools like AWS Step Functions for building serverless workflows across AWS services and EventBridge for connections applications. Interestingly, EventBridge currently supports a far wider range of third-party sources, but as the name implies, its focus is more on triggering events in AWS than moving data between applications.

- Details

- Category: Technology Today

Read more: AWS launches Amazon.com AppFlow, its new SaaS integration solution

Write comment (92 Comments)

Since first uploading a YouTube teaser video of its tech five years ago, Magic Leap presence in the augmented reality industry has been controversial.

Some have lauded the teamambitions, while others I&ve talked to say the companyposturing has dissuaded investors from taking chances on other AR hardware startups, which has hampered the industryadvance.

Regardless of its impact, Magic Leap carries outsized weight, leading one to question what would happen to other AR companies if the companysituation worsened.

The company announced layoffs today, with reports indicating that it is dismissing around 1,000 employees — about half of the company. Magic Leapadded news of a major pivot to enterprise makes it seem like that wasn&t its primary strategy over the past year. From my perspective, the company looks like it is on a path to a fire sale and will be dependent on executing a dramatic turnaround, which grows tougher under current economic conditions.

Magic Leap has few users, so a theoretical shutdown would likely have a lesser impact than other unicorn flare-outs; still, losing a company on the forefront of a technology lauded by many as the next ubiquitous platform will certainly impact others that are striving to bring this tech to market.

The impact for startups moving forward would be nuanced. Without a substantial software suite of its own, Magic Leap relied heavily on developer partnerships, though in recent months many of those seemed to promote enterprise use cases. AR/VR startups are already in a rough position, and one less developer platform could force more companies to de-prioritize headset-based platforms and shift their focus to mobile.

- Details

- Category: Technology Today

Read more: What happens if Magic Jump shuts down

Write comment (92 Comments)According to a new WSJ record and validated subsequently by TechCrunch, Costs Gurley, among one of the most renowned of Silicon Valley & s endeavor capitalists, is stepping method from Benchmark, the early-stage endeavor company that was founded in 1995 and also which Gurley joined right after, in 1999. According to its resources, he will not be spending the firm & s 10th venture fund, which is targeting $425 million in resources dedications. Gurley & s segue out of the company won & t shock lots of. Criteria —-- which has constantly run a relatively tiny operation —-- has consistently groomed brand-new investors as veterans of the company have actually moved on. When Standard elevated its last fund —-- another $425 million car in 2018 —-- it split methods with Mitch Lasky as well as Matt Cohler, that & d joined the company in 2007 and also 2008, respectively. The company & s cofounders —-- Bob Kagle, Kevin Harvey, Andy Rachleff, and also Bruce Dunlevie —-- also tipped away years back from actively spending for part of Standard, with Kagle stating in 2011 that he wished to sail a lot more, while Harvey entered into the wine-making business, where he has because established at least seven estate wineries from Santa Cruz to Mendocino under his company & s brand name, Rhys Vineyards. Each continues to provide himself openly as a general companion at the company, to preserve connections, and also, on uncommon celebration, to represent Benchmark on a board of directors as happened with Dunlevie, that joined the board of 10-year-old WeWork when Criteria led the business & s $17 million Series A round in 2012. (Dunlevie is now part of a special board of WeWork & s board of directors that is taking legal action against SoftBank for supposed breaches of agreement pertaining to its recent decision to cancel a $3 billion tender offer for WeWork shares.). Still, Gurley & s visibility will be missed out on. He is the longest-standing companion of Criteria and also absolutely the highest possible account, thanks partly to an active visibility on Twitter, in addition to Gurley & s very related to post and also, previously in his occupation, a normal column with Fortune magazine. He is likewise attributed with a few of the firm & s most profitable investments, consisting of, the majority of beneficially, a $10 million Series A bet in 2011 on a then-nascent Uber —-- a bargain that has taken place to generate lots of billions of dollars in returned resources to Benchmark & s investors. The bargain likewise tarnished Gurley & s reputation to a degree, after Gurley & who remained on Uber & s board —-- crafted the 2017 ouster of Uber & s cofounding CEO, Travis Kalanick. At the time, the manuever increased questions both concerning exactly how creator pleasant Benchmark is as well as likewise why, if Uber was being mishandled, Benchmark waited as long to act. In the meantime, partly due to the fact that Uber took its time in coming to be an openly traded company, Gurley had actually ended up being renowned in current years for cautioning founders to take their firms public faster —-- and to stop spending flippantly. At a Goldman Sachs technology meeting in 2018, as an example, he cautioned —-- not for the initial time —-- that gravy train was making owners less and also less accountable to their investors while also driving up appraisals to unworthy elevations. & Beware, & he & d said on stage. & It & s an unsafe time. &. As the most senior participant of Benchmark, Gurley has been attributed with maintaining the firm & s unwavering focus on early-stage investments, rejecting hundreds of numerous investing funding to increase fund after fund in the series of $400 million while other companies have actually developed larger as well as more numerous funds to handle. In 2016, Gurley admired the fad in discussion with this editor. & It & s not just the size of the funds but the speed & at which VCs are going back to their investors, he claimed at the time. & The Kauffman fund claimed that billion dollar funds drew, then everyone went out as well as raised billion-dollar funds. &. Benchmark itself raised one $1 billion fund throughout the go-go dot-com days, after a financial investment in eBay developed the young attire as a top firm. However Criteria rapidly changed back to smaller cars, determining it was error. We reached out earlier today to Gurley for talk about his plans. During, a resource validates that Gurley, whose 11 board seats include those of e-tailer Stitch Repair, virtual security firm HackerOne, as well as area social media Nextdoor, will certainly maintain those seats. Other basic companions at Standard include its latest hire, general companion Chetan Puttagunta, in addition to GPs Sarah Tavel, Eric Vishria, as well as Peter Fenton. In Gurley & s absence, Fenton will certainly end up being the most senior partner on the team, having signed up with Benchmark in 2006 from Accel, where Fenton was a capitalist formerly. According to the WSJ, Benchmark will certainly up be able up to spend one-fifth of the fund it is increasing in public business or elder, later-stage companies. Sources tell the WSJ that the move reflects the existing coronavirus-impacted environment, in which later-stage and openly traded business have actually seen their values plummet in spite of what may be solid principles in many cases. Nonetheless, a source close to the firm tells us that Standard has actually always preserved the option to put 20% of its resources right into mature personal firms, in addition to public ones.

- Details

- Category: Technology Today

China-based electric car startup Byton has furloughed about half of the 450 employees who work at its North American headquarters in Santa Clara, Calif., putting the release date of the automakerupcoming M-Byte vehicle into question.

Byton told TechCrunch the furloughs were the result of the COVID-19 pandemic. The intention is to bring these furloughed employees back, the company said without providing a timeline.

&Given the impact of the pandemic on the global economy and the auto industries we, like several companies, have had to take action to face the challenge,& a Byton spokesperson wrote in an email to TechCrunch. &The furloughs have affected all areas within BytonU.S. operations. Employees in China have not been furloughed.&

Electrek was the first to report the furloughs.

The furloughs come as the company is preparing to bring its M-Byte electric SUV into volume production later this year. The vehicle, perhaps best known for its massive 48-inch wraparound digital dashboard, will be produced at Bytonfactory in Nanjing, China. The M-Byte will be sold in China, the U.S. and Europe.

Byton previously said sales will begin in China in the second half of 2020, followed by the U.S. The vehicle will come to the first European markets in the first half of 2021. However, the COVID-19 pandemic — and the ensuing furloughs and cuts — could delay Bytontimeline.

Byton told TechCrunch it is evaluating the impact of COVID-19 on production of the M-Byte. BytonChina factory reopened in mid-February and is now nearly fully operational, according to the company.

Byton has raised about $820 million from investors that include the companyfounding team,FAW Group, Nanjing Qiningfeng New Energy Industry Investment Fund and CATL.

The startup has been working to close a Series C round of fundraising for months now. The company told TechCrunch it is in the &final stage& of the round, which will include investors FAW Group and the industrial investment fund of Nanjing municipal government, Myoung Shin Co. of South Korea, MS Autotech and Japanese enterprise Marubeni Corporation .

- Details

- Category: Technology Today

Read more: EV startup Byton furloughs half of its 450-person team in the United States

Write comment (95 Comments)Page 911 of 1444

9

9